In line with PREMO’s strategy of raising awareness, spreading knowledge and contributing to the development and spreading of augmented and virtual reality (AR & VR), we recently made available an e-paper written by Ezequiel Navarro, CEO of PREMO, discussing his insights into AR & VR.

This e-paper takes its basic ideas from an article posted on June 15th, entitled “Decoding the Goldman Sachs Report on Virtual Reality”, in which we reviewed the current investments of VC funds and market forecasts. If something could be extracted then, after analyzing the figures provided by Digi-Capital, it was that globally there is a certain feeling of optimism regarding the evolution of the VR/AR market.

Furthermore, a recent article published by The Economist on July 8th, under the title “Get Real. A reality check for virtual headsets”, announces that the wind of change may be finally blowing after a period of low performance, due to the gap between early forecasts and actual figures in the industry. The new publication of Navarro has included not only information from this second article, but it has merged also both scenarios in a marketwise and dynamic approach that helps to create a structured view of the industry both for specialists and newcomers.

As mentioned earlier, in our previous post we made clear that virtual reality (VR) has been identified by top investment funds and even by corporate and investment banks as more than a hype. In fact, it is the next big thing to happen. Plenty of investment opportunities have arisen, and consequently, many ways to obtain significant returns. It is a process with unicorns and also several bad and loud experiences.

How does the market forecast really look? What are our experts’ insights into VR & AR? According to many reliable and renowned sources, the market will experience a huge growth. But again, there are bears and bulls. When exactly? At what speed? To what extent? Considering the most recent information from several sources and publishers, the mentioned e-paper is intended to update the scenario, while bringing some insights related to the definition and size of the market, who the main players are and will be, and “What’s In It” for those who wish to operate in this market.

We Have Only Just Begun

VR dates back to Ivan Sutherland’s Sword of Damocles in 1968, and yet almost half a century later, we’ve only just started down the long road to what VR will ultimately be. The acquisition of Oculus, a startup in 2014, by Mark Zuckerberg’s Facebook opened the era of serious investments in VR. Plenty of statistics still remark today the disrupting effect that this visionary decision had in the market dynamics. Indeed, Zuckerberg described the VR technology as “incredible” and executed an early move that caught the attention of other investors.

In line with its strategy, Facebook recently hired Hugo Barra, a leading executive from Google and previously Xiaomi, consolidated nowadays as one of the fastest growing technology firms. Barra leads Facebook’s VR division and the first results have been displayed, since the firm has already presented “Spaces”, an innovative application were friends can socialize by VR meetings.

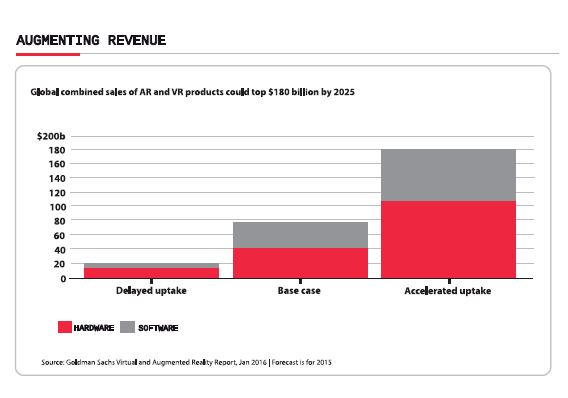

Why such a strong support to VR? Let’s not forget the forecast made by Goldman & Sachs in January 2016, envisioning total revenues of $80 billion by 2025, of which a very significant part of more than 50%, corresponds to hardware and its related key enabling technologies (KETs):

Shortly after, in March 2016, Digi-Capital announced a total investment of US$ 2.6 billion in the VR market, of which US$ 1.2 billion had been provided by VC funds. Finally, the same source anticipated that the installed base of VR/AR/MR devices will grow to 300 billion units by 2020, including PC and consoles (10%), mobile VR (20%), standalone AR/MR (35%) and smartphones & tablets.

A first obvious conclusion is that AR & VR hardware will account for the lion’s share of the cake. This is why tech giants are turning their strategies into KETs. Anyone interested in this matter knows that VR & AR have countless applications, but the challenge is getting enough processing power (from GPUs and CPUs) along with high precision, low energy consumption and low cost. Ultimately, hardware is once more the key, with an expected share of more than US$ 30 billion by 2020. It is worth mentioning that another notable KET corresponds to immersive technologies.

While experts like, Tim Merel, from Digi-Capital, think that the true boost of this market will take longer than announced and that its growth will happen later and at a slower pace, there is no question about its growth in general terms. However, looking more into detail, possibly not the whole market will expand simultaneously.

Appetite for AR & MR

The market analyst Superdata Research recently made public that the funding of VR is drying out but that there is still plenty of appetite amongst investors for augmented reality (AR) and mixed reality (MR). Among the 6.3m headsets shipped last year, most were cheap, unsophisticated devices, such as the Samsung Gear VR, that rely on smartphones to act as their screens.

Some tech giants still see VR as integral to their future. However, other tech firms reckon VR may be a stepping stone to a bigger prize: augmented reality (AR), which allows users to overlay the digital world onto the real one. AR has far more everyday applications than VR, which is expected to be used chiefly for leisure activities and in industry. For example, Apple believes that AR will become a bigger phenomenon than VR and is acting accordingly. Later this year, the US giant will start putting augmented reality software in as many as a billion mobile devices.

Whether it be VR, AR or MR, attending to an analysis for each industry, it is generally accepted that the biggest share of the market in the early stages will remain mostly for video games and healthcare, while there will be increasing opportunities in engineering, live events, retail and even military use. Augmented reality (AR) is expected to be a market at least 3 times larger than that of VR:

Anyway, there is a gap between users and business forecasts, so the adoption rate should eventually be much higher. Up until now the market has shown signs of a delayed uptake, but this could change swiftly anytime given the potential, if the current blocking factors, of which we will talk about later, can be solved.

The overview of the market is good, especially for us hardware developers and manufacturers, as there is a clear need for high quality, reliable, wireless and affordable hardware to run applications. Hunger for wireless devices and a better immersion experience are a fantastic tailwind for everyone involved in Electromagnetic Motion Capture Sensors and Systems. Nevertheless, HW – as usual – will be surpassed by SW by 2020. We have seen this in other platforms (PCs, smartphones, ICT and smart vehicles). Until that day comes, HW will play just as an important role as SW, or even more, due to its crucial potential impact into allowing mass adoption by end users.

In Pursuit of The Top Positions

The players in this industry know it. New headsets from a variety of hardware firms—Acer, Asus, Dell, Lenovo and Hewlett-Packard—all running on Windows, are expected later this year. Many new games and entertainment products using VR are poised to go on sale. Better technology and more content will encourage gamers who were on the fence to join in. headsets will become smaller, cheaper and wireless, ultimately leading to the achievement of a sensation of complete immersion, called “presence”. Boosters of VR say it is what will drive the technology’s mass adoption, in time.

Currently, VR hardware comes in two flavors: cheap headsets that turn smartphones into virtual reality players (like Samsung’s $130 Gear VR) and high-end gaming rigs (like Facebook’s $400 Oculus Rift) that hook up to $1,000+ desktop computers. Facebook’s new headset is designed to bridge that gap, a device that will sell for as little as $200 and need not be tethered to a PC or phone. It will ship next year and represent an entirely new category. According to IDC, once hardware becomes available for the majority of potential end users, annual shipments could amount to over 75 million units in just 5 years!

The massive potential of this industry is not secret at this point, and as stated, some key players are positioning themselves with strategic moves. In this sense, as published in the technology website VentureBeat, earlier this year HTC became an official partner with Google in producing a Daydream-based standalone VR headset under the Vive brand. Today, HTC announced it is producing a similar device for the Chinese market powered by Qualcomm’s Snapdragon 835 chipset. It looks like it will access HTC’s storefront, called Viveport, to get to virtual worlds rather than Google Play.

These standalone systems are designed to be far more convenient than Rift and Vive because they don’t require separate hardware like a phone, PC or dedicated external tracking systems to operate. It is unclear, however, how compelling the virtual worlds will be that you can visit with these standalones.

Key Questions

With so many stakeholders of the virtual revolution scrutinizing the market and taking positions in order to obtain as much profit as possible from it when the boom finally comes, Navarro’s e-paper accurately addresses one of the most important factors that remain hidden as of today. With a market that shows clear vital signs and a promising future, we as hardware manufacturing players that aim to lead not far from now, must ask ourselves: when will the pool of consumers be ready for mass adoption of our solutions? And what can we do to help them?

The social adoption cycle is a well-known classic:

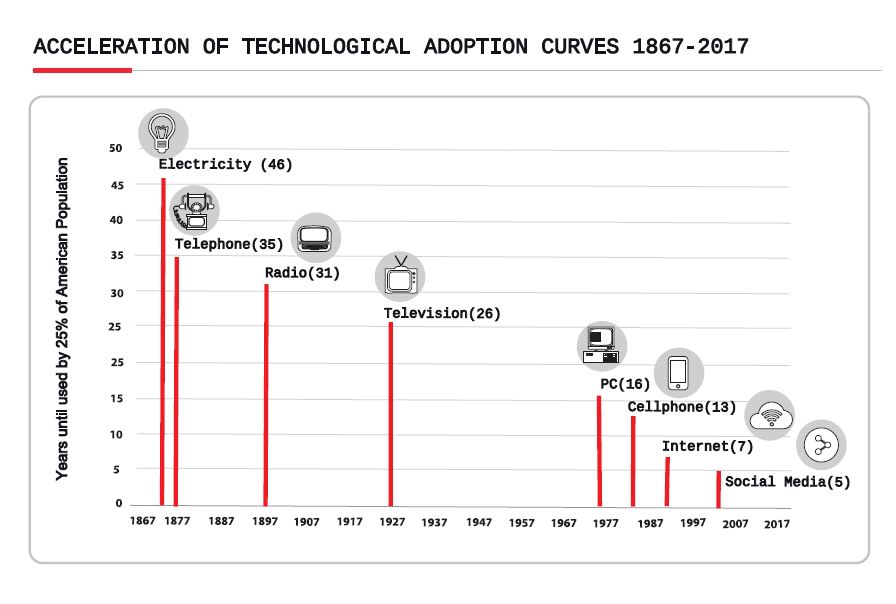

We need to know now whether we are still addressing the first 2.5% of innovators or entering a larger volume phase of the curve. Early and Late Majorities probably will be the cash cows and the consolidation of the platforms but for us, technology companies, it is a fact that the standards and definitions for the whole life cycle are set in the first two stages. In addition to being familiar with the adoption graph, we are also aware that the speed of adoption is increasing dramatically, partly thanks to economies of scale in an increasingly connected and globalized market.

If phone adoption by the first early majority took 35 years in USA, TV took a span of 26, Internet a shorter period of 7 years and Social Media (Facebook, Twitter, Instagram) just 5 years, make your bet. How long will it take for VR and AR to be adopted by up to 25% of the American population? Only when the current biggest bottleneck, hardware, becomes widely available, affordable, simple and compatible with multiple systems, we will witness the real launch and mass adoption of VR.

What about the rest of the world? Will an increasingly competitive Asia just sit and look? Not likely; HTC, Sony, Nintendo, Samsung, LG, Lenovo are already big players and only naturally the second largest economy of the planet will have a lot to say about this technology. Chinese firms have been surprisingly quick to research and invest in systems that are smaller, cheaper and wireless, and as a result this industry is churning out new proposals. Most importantly, the Chinese government is supporting this development as mentioned by Xi Jinping, as they envision VR as an important vector for economic growth. Thanks to a favorable business climate, Chinese tech giants like are getting ready for when the VR wave finally arrives.

The market indicators shown by The Economist, mentioning SuperData Reseach, and processed in our published e-paper, are promising. Most companies grew from 2016 to 2017 and in average the market will roughly double itself by next year. Nevertheless, analysts mention that the supply constraints in headsets and lack of availability of devices, like Oculus Rift in 2016, delayed both HW and SW revenue, but, as far as we know, those issues have been solved and the big players are focusing now on developing HW platforms that are more user friendly, wireless and accessible in every respect.

The industry is aware that 2016 was presented as the VR year, but the reality falls short. Objectively, today the global market for VR headsets remains tiny. In the first quarter of 2017, hardware makers shipped 2.3 million of devices, according to IDC, compared with 347 million smartphones. As explained previously, mainly buggy hardware and pricey headsets apart from insufficient contents are holding back mass adoption. Right now Samsung leads the pack with about 22 percent of the global VR market, according to IDC. Facebook’s Oculus Rift is in fourth place, behind Sony and HTC, with about 5 percent of the market, or less than 100,000 units sold.

On the long journey to mass adoption of augmented and virtual reality, experts mention several hurdles to mass adoption. Since VR is mostly about driving the perceptual system, mainly the following senses are crucial: vision, audio, haptics, etc. Others matter too, such as smell or taste, but that are far away from being mastered, so not in the industry’s scope of action so far.

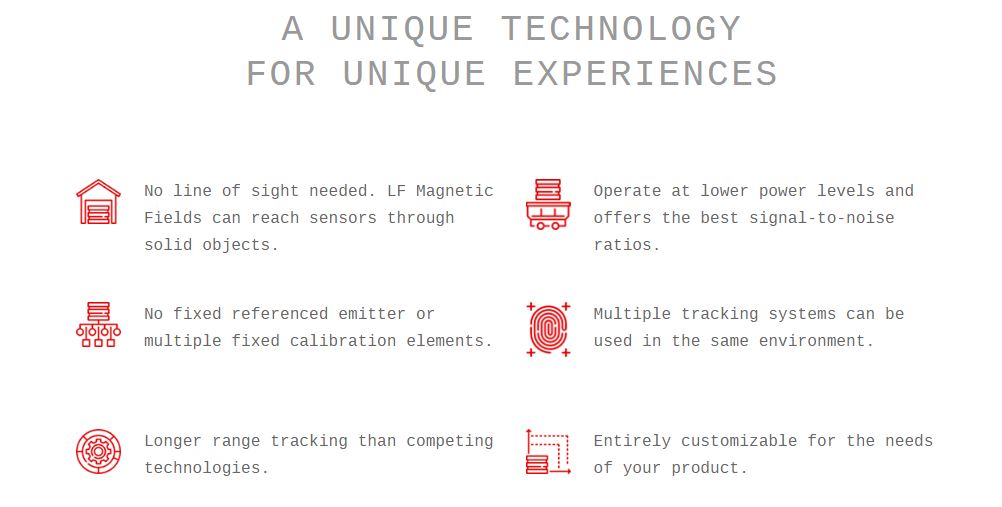

Concerning what we do at PREMO and what we are good at, haptics is particularly challenging. The haptics that will probably matter most, at least in the initial years, would be for the hands, which are our primary means of interaction with the world. Precisely, in order to interact with the world on a full scale at some point in the future, eye, hand, and face tracking will be crucial to provide a realistic experience. PREMO works actively on this field and associated challenges, through Electromagnetic Motion tracking coils, which provide superior performances than any other equivalent technologies.

Challenges Envisioned In Virtual Reality

When it comes to identifying or classifying the many challenges face nowadays, they could be boldly listed as below. The solution that PREMO envisions for each one of them can be found in the recently published e-paper, about which we already spoke and in which the author aims not only to inform, but also to promote critical thinking.

Gear is expensive and awkwardly heavy or clumsy. With many new technologies, price influences consumer adoption, and a decrease may drive enterprise adoption as well. As prices fall, expect enterprise experimentation and deployment to increase. As lighter and sleeker devices become available, their adoption will grow.

A powerful computer or gaming console is required. AR & VR require a substantial computing power to create high-quality graphics, reduce lag between a user’s movement and the display’s response, and increase the visual frame rate to more than 90 frames per second (FPS), a rate that won’t induce motion sickness. The development of dedicated processing units that can increase computing power and speed, while reducing power consumption, will allow AR/VR hardware to do more.

Many guidance and collaboration applications will remain impractical until the batteries in AR/VR headsets can last an entire work shift—at least eight to ten hours. Most devices on the market currently last less than half that time. As battery life increases, so will the appeal of these applications.

Consumers do not spend on HW that has not many applications/games to run yet.

Developers don’t invest in a small and fragmented market of different not compatible headsets that require a lot of repeated coding efforts.

The way users have to wave around handheld controllers to input movement falls short of the promises of VR. Also, the human field of view can extend to approximately 180 degrees, the middle 114 of which is considered to be binocular in which humans use both eyes and can perceive depth and distance. Although many devices have fields of view just higher than 100 degrees, increasing the field toward 180 degrees will expand a worker’s observable environment and enable more immersive experiences.

Our own experience tells us that most of the blocking points described above are being seriously addressed and most of them already in the process of being solved. Especially the need for haptics, sensors and the feeling of real presence, which is no other than the sensation of complete immersion, who Boosters of VR say is what will drive the technology’s mass adoption, in time. The massive use of Electromagnetic Motion tracking for MOCAP (Motion Capture) brings the exceptional opportunity of obtaining simple, affordable and wireless hardware that will enable a significant presence.

Having developed our first 3D coils more than 20 years ago, we are in an second-to-none position in terms of experience, time to market, customization capabilities and product range. With our series of highly efficient small sized receptor and emitter coils, we provide the possibility of reducing gear dimensions and weight, reducing latency while keeping the highest performance that can be found in the market, ultimately leading to a fully immersive and realistic experience.

Soon after improvement of the current bottlenecks, a great variety of sectors will merge in and adopt this technology. The VR industry has not yet fulfilled the hype, but the believers have not lost their faith. According to Deloitte, the industry could eventually have a free way to develop and market several applications with great benefits for several key fields of activity, still limited today:

As we’ve seen, a good number of organizations are already exploring enterprise applications of AR/VR. As the technology continues to improve, the case for testing, adoption, and deployment will become stronger, but solving the current bottlenecks is just the gate that opens the achievement of real possibilities. The reality we experience is whatever our minds infer it to be based on perceptual inputs, regardless of the source. So if VR can provide the right perceptual inputs, we can have whatever experiences we want, and those experiences will feel real.

It will take time, possibly several years to fully solve each of the challenges listed above. In short, VR is a truly vast space waiting to be explored, and much more research attention needs to be focused on it. Without a doubt, decades of innovation lie ahead, as announced Oculus Chief Scientist Michael Abrash recently at the third Global Grand Challenges Summit. After all, we are talking about the second greatest leap of history technology wise after the creation of the computer. One day, instead of interacting with the digital world through flat screens, we’ll be able to live in the digital space whenever we want.

VR is a grand challenge in the purest sense. Obviously, it’s highly difficult, requiring research and development across dozens of technologies, but that’s only half of the story. As Abrash claimed, “VR is the culmination of more than 70 years of the computer revolution and centuries of development of information technology. We’re finally capable of building an interface that lets us interact with the digital world using a significant fraction of the full bandwidth and biological processing that we’re evolved for.”

At PREMO Group we want to be a part of this revolution, and while we work and learn day after day to solve part of the challenges, we also commit to share the knowledge we acquire on the way.

When all this comes together we will finally be able to enter the world that William Gibson, acknowledged creator of the word “cyberspace,” described back in the 1970s.

Wow, Great article. Thank you very much for share.

Discover more

products

VR

View moreTx/Rx

View more3DV06

View more3DV09

View more3DV11AOI

View more3DV15

View moreVR

View more3DCC08

View more3DCC10

View more3DCC20

View more3D20LW

View more3DCC28

View more3DTX10

View more3DTX08

View more3DCD90

View more3D28LW

View moreFind out more Contact us

Our webstore uses cookies to offer a better user experience and we consider that you are accepting their use if you keep browsing the website. Cookies Policy ACCEPT